Health care fraud is stealing:

* It steals money from health insurance companies.

* It steals money from taxpayer programs, such as Medicare and Medicaid.

* It steals money from you.

The stealing is done on purpose when someone submits false information to get paid for health care benefits. Health care fraud is a big problem. It occurs every day across the U.S. Persons from all ages, races, and incomes are victims of it.

Types of Fraud

Ways Medical Providers Commit Health Care Fraud

* They bill for services and/or supplies that were not given. A provider may use real patient information to fabricate an entire claim. Or, a claim can be padded with charges for services, etc. that did not take place.

* They bill for services that cost more than the ones that were given. This is called “upcoding.” For example, a provider may submit a claim for an extended office visit when the patient was seen only briefly. On the claim, the provider uses the code number for the extended visit, not for a brief visit, which costs less. Often, the provider “inflates” the patient’s diagnosis to justify billing for the more costly service.

* They charge more than once for the same service. This is double billing.

* They give services and/or order tests that are not medically needed. This is done just to get the insurance payment. The provider may even give a false diagnosis to justify doing this.

* They claim a non-covered treatment as one that is a covered expense. For example, a cosmetic surgery, such as a “tummy tuck,” is billed as a hernia repair.

* They bill separate claims for services that should be billed together as one. For example, surgery on four fingers done at the same time is billed as four claims, not one.

* They waive co-pays. This means they don’t collect money that patients should pay for out of their pockets. When patients don’t have to pay anything, they are more likely to agree to have services that aren’t medically needed. Also, health care providers use this practice as a way to misrepresent their “usual” fees to insurance companies and bill them for more than they should.

* They take money in exchange for patient referrals.

* They let an unlicensed person provide services and bill for them.

Ways Patients Commit Health Care Fraud

* They submit claims for services, medicines, etc. that they didn’t get.

* They let another person use their health insurance card. They use someone else’s card.

* They change or forge bills, prescriptions, or receipts.

* They give wrong information on purpose to receive benefits.

* They fail to give information to the insurance company.

* They try to add someone who is not legally a dependent to their insurance plan. To do this, they lie about their marital status, paternity, etc.

* They don’t let the insurance plan know about a divorce. They do this on purpose to keep coverage for the ex-spouse and/or step children who are no longer eligible for coverage under the plan.

* They fail to disclose other insurance coverage. This could be worker’s compensation for an on-the-job- injury. It could be auto accident insurance payment for health care costs.

* They take money or other perks from a provider for receiving services.

Ways Others Commit Health Care Fraud

* Identity theft. Health insurance card(s) or number(s) are taken and used to bill insurance programs for treatment not given.

* Mobile labs. Diagnostic labs in trailers, etc. give fake or needless procedures to consumers. Then, they bill insurance programs for costly procedures.

Affects of Fraud

Health Care Fraud Costs You Money

* It makes you pay more for health insurance. Your premiums go up. You pay more for out- of-pocket costs. Your co- pays and deductibles cost more.

* It increases the cost for Medicare and Medicaid. As a result, you may need to pay more taxes. Also, tax dollars spent on health care fraud leaves less money for other taxpayer programs, such as education.

* It increases costs in general. To cover increased costs for employee health benefits, companies need to charge more for products. Things you buy, such as cars, clothes, computers, etc. end up costing more money.

Health Care Fraud Can Affect Your Health

* It can cause harm. Scam providers may order treatments that you don’t need. This includes heart surgery, which can threaten your life. They do this just to make money from your insurance company.

* It can use up lifetime caps or other limits of your benefits. Money used for false claims and needless treatments count toward your lifetime or other limits.

* It could cause injury and even death. This can occur in auto accidents that are staged to collect insurance money.

Detect Fraud

Ways To Detect It

Fighting health care fraud is a priority for companies, insurers, and the government. They are using many measures to do this. These include:

* Computer software programs that help detect fraud. One kind analyzes data for trends or ratios that are unusual or not expected. Another kind quickly sorts data to get certain information, such as:

– False billings.

– Billing too much.

– Billing too little.

– Unusual patterns for paying vendors, etc.

Software can also “rebundle” claims. This allows the insurance company to see if services performed at the same time were billed for as ones done at different times. These software programs don’t detect all types of fraud. Nothing about the coding or payment would signal fraud. For example, the software would not detect billing for an extended office visit when a brief visit was done.

* Special Investigation Units (SIUs). These include trained professionals in accounting, health care, law enforcement, nursing, etc.

* Fraud bureaus. These were created by state insurance regulators. They are found in most states.

* Employee training.

* Fraud hotlines.

What You Can Do

Ways To Help Prevent Health Care Fraud

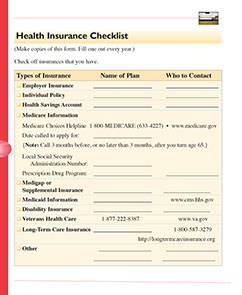

* Learn about your health insurance. Read about your benefits. This can be in a booklet. It can be on the insurance company’s Web site.

* Find out what the plan does and does not pay for. Find out what you pay. Learn what the plan’s limits are. If you have more than one health plan, find out which expenses are covered by each plan. This prevents more than one plan from paying for the same service. Would you want an item you charge on a credit card to be billed on two credit cards?

* Ask questions about proposed treatment, tests, etc. Are these needed and why? What do they cost? Get a second opinion if surgery is proposed.

* Fill out, sign, and date one claim form at a time. I Keep a record of your medical care. Note the following:

– Dates and places of care.

– Services received.

– Names of persons who treated you.

– Medicines, supplies, and equipment you received.

– Tests and other services that were ordered and if they were done.

* Don’t sign blank claim forms.

* If your health insurance company was not yet billed for services, give the provider your insurance information.

* Read the Explanation of Benefits (EOB) statements you get. An EOB is a report from your insurance company. It shows what it paid for and what it did not pay for. It is not a bill.

– Compare the dates of services, procedures, tests, etc. with your medical bills. Do they match?

– If you don’t understand the EOB form, contact your insurance company.

* Compare your medical bills and the EOB statements. Contact your provider and your insurance company to report errors.

* Protect your health insurance ID card. It represents your benefits. In general, be careful about giving out your insurance information.

* Don’t buy health insurance online

* Don’t buy health insurance from persons who sell it door-to-door or on the phone.

* Be wary of persons who offer cash or free items or services to get you to buy insurance.

* Read all medical bills you get from your doctor, hospital, etc.

– Check the date(s) of service. Are these correct?

– Look for errors.

– Check to make sure that you received the services you are being billed for.

– If the bill just lists a total charge, ask for an itemized bill. {Note: Ask for an itemized bill when you leave a hospital.} Ask for one that lists services in words you can understand, not just code numbers. Why? When providers bill for services, they use code numbers for diagnoses and procedures, such as ones called ICD-9-CM Codes. If necessary, ask what the code numbers stand for.

– Check to see if you were billed more than once for the same service. Double-billing is a common error.

– If a bill lists “miscellaneous” charges, find out all the items this includes.

– If you don’t understand a bill, call the number on the statement. Call your insurance company, too. Get problems resolved before you pay for a bill or have the insurance company send payment.

* Know about the “qui tam” part of The False Claims Act. This allows a person to bring a civil case against persons who submitted false claims to the government, such as to Medicaid. If the lawsuit results in a court judgment, the “whistle blower” can get part of the money made.

Is health care fraud a crime?

Yes, it is a very serious crime. For the Department of Justice, health care fraud and abuse is the number two priority after violent crime. Persons convicted of health care fraud can go to prison. They can pay hefty fines. If the fraud they commit causes someone to die, they could be sentenced to life in prison.

The cost of health care fraud is huge.

* Some estimates by government and law enforcement groups say it costs as much as $180 billion dollars a year!

* Medicare and Medicaid are big targets. One out of every seven dollars spent on Medicare is due to fraud and abuse.

Resources

BNA Health Care Fraud Report

www.bna.com/products/health/hfra.htm

Coalition Against Insurance Fraudwww.insurancefraud.org

National Fraud Information Center/Internet Fraud Watch

www.fraud.org

National Health Care Anti-Fraud Association (NHCAA)

www.nhcaa.org