Tag: enrollment

-

Medicare

Medical Care

Medicare is health insurance funded by the federal government. There is a lot to know about Medicare. For information, call the Medicare Choices Helpline at 1-800-MEDICARE (633-4227). Ask that a copy of the Medicare guide be mailed to you. You can also find out about Medicare on the Internet atwww.medicare.gov.

To be “eligible” for Medicare means:

* You are 65 years or older. You must also be eligible for Social Security or Railroad Retirement Benefits, or

* You must be disabled for life and you have received Social Security Disability Insurance payments for at least 24 months, or

* You have end stage renal disease needing transplant or dialysis.

To apply for medicare, call the Social Security Administration. The number is 1-800-772-1213. Call 3 months before you turn age 65. Don’t wait any longer than 3 months after your 65th birthday to call. If you receive social security payments, you should automatically get a Medicare card, but don’t take a chance. Call the Social Security Administration as mentioned above.

-

Planning For Health Care Coverage

Medical Care

Medical costs are expensive. Whether you are in your 50s, 60s, 70s, or older, now is the time to review how you cover them. Now is the time, too, to plan for how they will be paid for in the future. Without health insurance, some persons could lose all their assets if they had to pay for medical expenses.

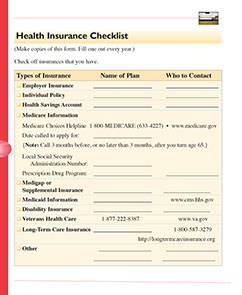

Like life insurance, health insurance can be hard to understand. Don’t let it baffle you, though. Find out what you need to know to protect yourself and your assets. Don’t find out you have too little coverage when it’s too late. Use the “Health Insurance Checklist” to keep track of your health care coverage.

If you are a Veteran, find out about Veterans health care from

-

Navigate Open Enrollment

WELL-BEING

Make the most of your benefit plan, especially during open enrollment periods. Here are money-saving tips from HighRoads, a benefits management company.

*Get your plan materials.Some companies are giving you a Summary Plan Description online, via mobile apps, as well as on paper. It’s good to know how you can access this information during open enrollment and throughout the year, in case you want to review it again when you are in need of a particular medical service. Take time to read the plan.

*Calculate your costs.Many employers provide cost calculators to help project your total cost for the coming plan year. The total cost includes the premium you pay as well as your share of the deductible and coinsurance. Take the time during open enrollment to think through your potential medical needs and calculate your anticipated expenses before selecting a plan. It may save you hundreds in the long run.

*Consider an account.Your employer may offer you the option of a health care account, whether it is a flexible spending account, a health reimbursement account, or a health savings account. These accounts can help you save money on qualified medical expenses that aren’t covered by your health care plan, such as deductibles and coinsurance. Each account has a different set of rules about how and when you can spend the money, but each is worth considering because the savings you’ll see can add up quickly.

*Is prevention covered?One of the benefits of health care reform is an extended list of preventive care benefits that must be offered by new health care plans for free. Preventive services such as colonoscopy screenings, Pap smears and mammograms for women, well-child visits, and flu shots for all children and adults must be offered without out-of-pocket costs. However, these benefits are only for new health plans and don’t apply to “grandfathered” plans that haven’t significantly changed in a few years.

*Use wellness incentives.More employers than ever before are offering incentives such as premium discounts, low deductibles, gym memberships, or prizes to employees and their family members for health improvement.

*Know your deadlines.No matter what changes you may make, if any, during this year’s open enrollment period, don’t let your selection deadlines slip by without action.