The Consumer Financial Protection Bureau says everyone should check their credit report at least once a year. The information on your credit report could affect your ability to get a mortgage, car loan, a credit card or other loans. It can also affect the interest rate you get. Usually, a higher credit score makes it easier for you to get a loan and a lower interest rate. Most credit scores range from 300-850.

You are entitled by law to a free report from all three credit reporting agencies (Equifax, Experian and TransUnion) once every 12 months. Take advantage of it – and check it over carefully when you receive it.

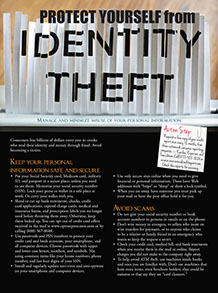

But what should you look for when you get your report? Errors can happen, so be on the lookout for:

* Wrong name, phone number or address

* Accounts that don’t belong to you (this can happen when two people have similar names, or as a result of identity theft)

* Closed accounts reported as open

* Being listed as owner of an account where you are only an authorized user

* Accounts incorrectly reported as late or delinquent

* Wrong dates of payments, when the account was open or delinquency dates

* Same loan or debt listed multiple times (possibly with different names)

* Past errors that were corrected that may show up again

* Incorrect current balance or credit limit

* Accounts that appear more than once with different creditors listed (especially in the case of delinquent accounts or accounts in collections)

If you find errors, contact:

* The credit reporting company who sent you the report, or

* The creditor or company that provided the incorrect information. This is known as the “furnisher” of the information.

Your credit report tells you how to dispute inaccurate information. Sample dispute letters are available atwww.consumerfinance.gov. Go to Consumer Tools, then click on Credit Reports and Scores. You can use these letters if you find something incorrect on your credit report.

How do I get my report?

Many websites claim to offer free credit reports. But, some of them are trying to sell other products or services. To get your free credit report authorized by federal law, visit:

* AnnualCreditReport.com, or

* Call 1-877-322-8228

This website offers free reports only, not scores. Your credit score is available for a fee. You do not have to buy any products or services advertised onannualcreditreport.com.

You can also contact the credit agencies directly if you have questions or problems with your report:

* Equifax: 1-866-349-5191

* Experian: 1-888-397-3742

* TransUnion: 1-800-916-8800