Financial Health

1. Track your monthly expenses.

– List fixed costs. These include mortgage or rent, car payment, phones and child care.

– List costs that vary, such as clothing, eating out, personal care, and entertainment.

2. Make and follow a plan to pay down debt. Do this on your own or with professional help.

3. Plan a budget. From your net income, aim for:

– 50% for basics (house, food, transportation)

– 30% for lifestyle choices (hobbies, phone and cable, personal care, pets, eating out)

– 20% for short-term savings and retirement

4. Get tools to help you manage your financial health frommymoney.gov.

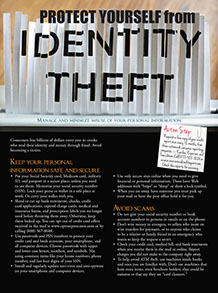

Take Action: Keep Your Numbers Safe

1. Protect your bank account, credit card, driver’s license, social security, and other personal ID numbers.

2. Use secure websites, passwords, and PIN numbers. Change passwords often, using upper and lower case numbers and symbols. Consider using multi-factor authentication (MFA). This is an added layer of security to your information where a system requires you to present a combination of two or more credentials to verify your identity.