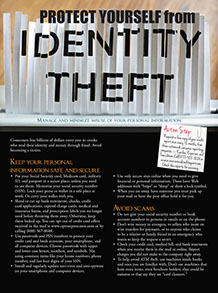

Financial Health

Manage and minimize misuse of your personal information

Consumers lose billions of dollars every year to crooks who steal their identity and money through fraud. Avoid becoming a victim.

Keep your personal information safe and secure:

* Put your Social Security card, Medicare card, military ID, and passport in a secure place, unless you need to use them. Memorize your social security number (SSN). Lock your purse or wallet in a safe place at work. Or carry your wallet with you.

* Shred or cut up bank statements, checks, credit card applications, expired charge cards, medical and insurance forms, and prescription labels you no longer need before throwing them away. Otherwise, keep them locked up. You can opt out of credit card offers received in the mail atwww.optoutprescreen.comor by calling (888) 567-8688.

* Use passwords and PIN numbers to protect your credit card and bank accounts, your smartphone, and all computer devices. Choose passwords with upper and lower case letters, numbers, and symbols. Nix using common items like your house numbers, phone number, and last four digits of your SSN.

* Install and regularly update anti-virus and anti-spyware on your smartphone and computer devices.

* Use only secure sites online when you need to give financial or personal information. These have Web addresses with “https” or “shttp” or show a lock symbol.

* When you are away, have someone you trust pick up your mail or have the post office hold it for you.

Avoid scams:

* Do not give your social security number or bank account numbers to persons in emails or on the phone.

* Don’t wire money to strangers, to sellers who insist on wire transfers for payment, or to anyone who claims to be a relative or family friend in an emergency who wants to keep the request a secret.

* Check your credit card, medical bill, and bank statements when you receive them in the mail or online. Report charges you did not make to the company right away.

* To help avoid ATM theft, use machines inside banks and ones you are familiar with. Don’t use machines that have extra items, even brochure holders, that could be cameras or that say they are “card cleaners.”

Action Step

Request a free copy of your credit report once every 12 months from three nationwide consumer reporting companies – Equifax, Experian, and TransUnion. Call (877) 322-8228. Check the reports for accuracy.